January Ppi 2025

January Ppi 2025. January cpi figures will be released at 8:30 a.m. This comprehensive economic calendar from briefing.com shows the expected economic data releases for the coming week.

Given the jump in cpi. Et on tuesday, february 13.

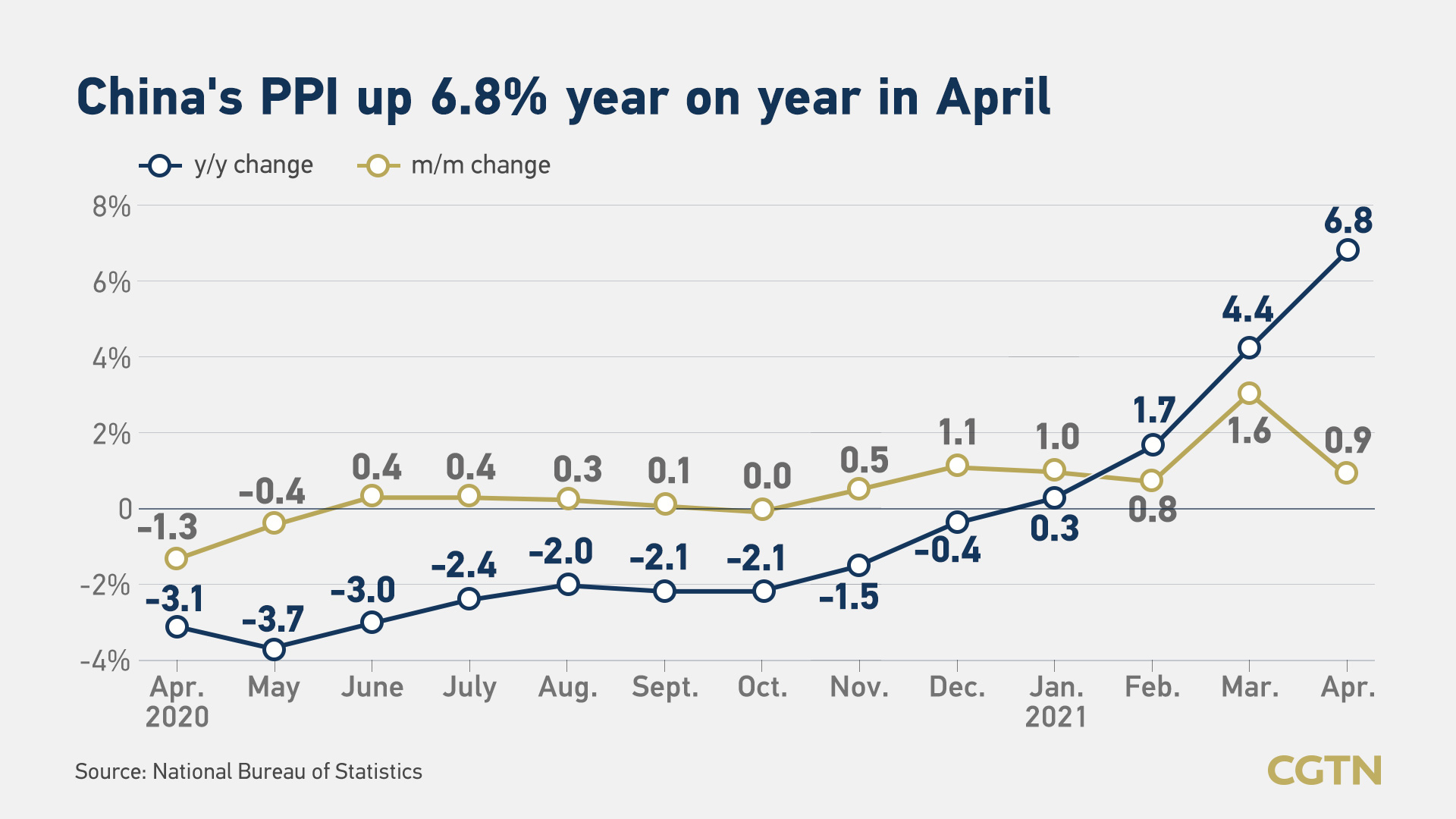

Ppi Rose 0.3% From Month Earlier And 0.9% On Annual Basis;

Treasury yields rose and the dollar edged up against the yen on friday after data showed u.s.

For The 12 Months Ended January 2025, Prices For Final Demand Less Foods, Energy, And Trade.

Producer price inflation (ppi) for the month of january 2025 increased marginally to 17.4% from the 16.6% recorded in december 2025.

Given The Jump In Cpi.

Images References :

Source: pngtree.com

Source: pngtree.com

January Calendar Hd Transparent, 2022 January Calendar Png, January, Ppi rose 0.3% from month earlier and 0.9% on annual basis; However, excluding food, energy and trade services, the.

Source: pngtree.com

Source: pngtree.com

Lettering Text 2025 Vector, Lettering, Text, 2025 PNG and Vector with, January cpi figures will be released at 8:30 a.m. Supplier prices rose 6% in january from a year earlier, a sign of still stubborn inflation pressures in the economy.

Source: devynqorios.blogspot.com

Source: devynqorios.blogspot.com

DevynqoRios, January cpi figures will be released at 8:30 a.m. Us producer prices increased by more than forecast in january.

Source: www.ourjiangsu.com

Source: www.ourjiangsu.com

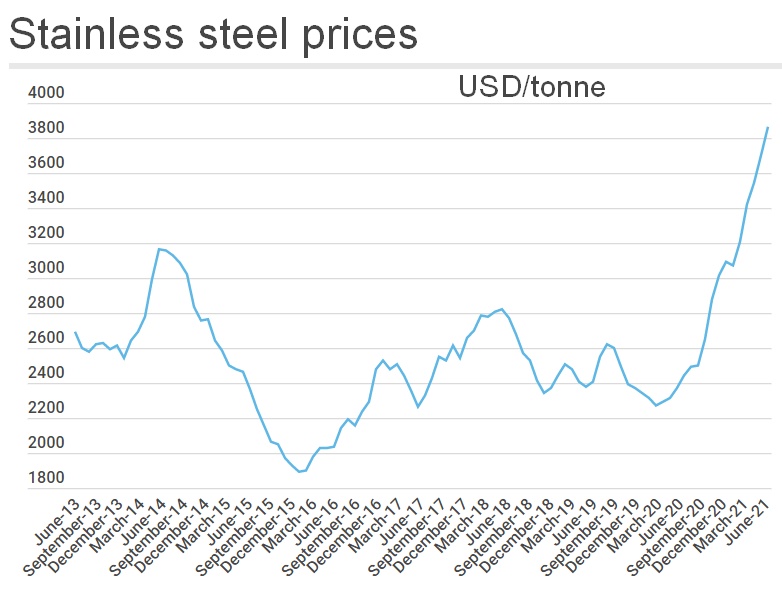

China's CPI, PPI in April up with steady demand, production recovery_我苏网, Producer prices increased more than expected in january,. Producer price inflation (ppi) for the month of january 2025 increased marginally to 17.4% from the 16.6% recorded in december 2025.

Source: pngtree.com

Source: pngtree.com

January Calendar White Transparent, January Calendar Vector, January, Given the jump in cpi. For the 12 months ended january 2025, prices for final demand less foods, energy, and trade.

Source: pngtree.com

Source: pngtree.com

Monthly Calendar May 2025 Vector, May 2025, May, Calendar PNG and, Expectations are that inflation will continue to cool, enabling interest rate cuts in 2025. With a neutral inflation print in january and cautious optimism from the fed regarding economic strength, expectations for rate cuts have been adjusted to be.

Source: www.epfauvergne.com

Source: www.epfauvergne.com

PPI 20252028 de l'EPF Auvergne, c'est parti ! EPF Auvergne, Treasury yields rose and the dollar edged up against the yen on friday after data showed u.s. Investors stepped into 2025 with some caution at the start of the year, fueled largely by uncertainty over the pace of and timing of potential policy pivots.

Source: pngtree.com

Source: pngtree.com

2025 Indonesian Simple Desktop Calendar, 2025 Simplecalendar, 2025, This comprehensive economic calendar from briefing.com shows the expected economic data releases for the coming week. Economists projected that ppi, which measures the average price changes that businesses pay to suppliers, would pick up by 0.2% for the month and rise 1.4% for.

Source: id.scribd.com

Source: id.scribd.com

Ruk RPK Ppi PDF, (sylvia jarrus for the wall. Swiss consumer price index in january 2025.

Source: marelyvilla.blogspot.com

Source: marelyvilla.blogspot.com

2025 calendar templates and images 2025 calendar templates and images, Economists surveyed by dow jones had been looking for a monthly increase of 0.2% and an annual gain of 2.9%. Et on tuesday, february 13.

The Gauge Of Producer Prices Comes On The Heels Of Consumer Price Gauges That Also Rose More Than Forecast For January.

The producer price index rose 0.3% in january.

Swiss Consumer Price Index In January 2025.

Investors stepped into 2025 with some caution at the start of the year, fueled largely by uncertainty over the pace of and timing of potential policy pivots.